Cryptomus Exchange Review: Is It Really Safe in 2025?

When you search for crypto payment solutions in 2025, Cryptomus often shows up on recommendation lists. But glossy reviews rarely tell you what it’s really like to use it daily. That’s why I ran my own Cryptomus Exchange Review, moving real funds through deposits, payments, swaps, and withdrawals. This wasn’t just a quick sign-up test—I spent hours comparing it to PayPal, Binance Pay, and smaller P2P apps to see if Cryptomus could stand up to real-world pressure.

Cryptomus Exchange Review: First Impressions After Sign-Up

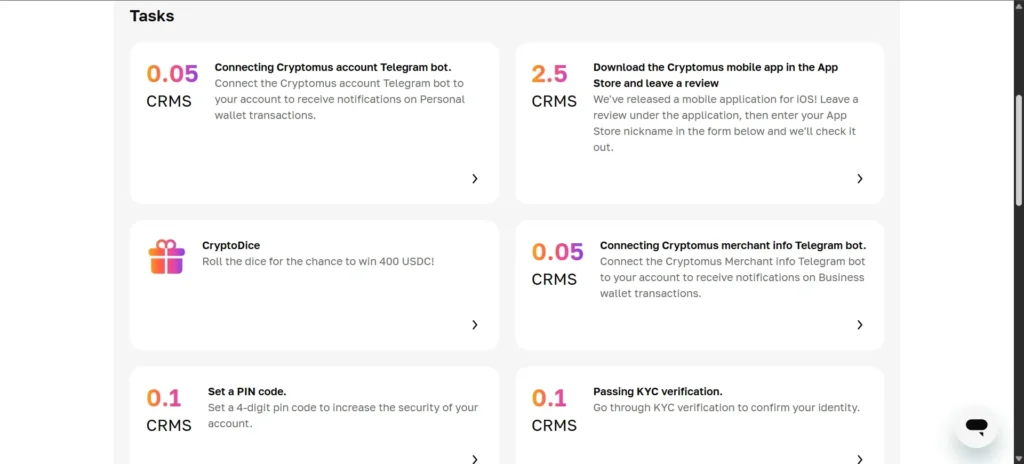

Registering on Cryptomus feels refreshingly simple. I didn’t need to upload a stack of documents or wait days for approval. Within five minutes, my account was ready, and I could deposit USDT and BTC immediately.

The dashboard looks stripped down, but that’s a good thing. Everything is one or two clicks away—send, receive, swap, invoice creation. Compared to Binance or OKX, which can overwhelm beginners with endless tabs, Cryptomus focuses on what you actually need to do.

However, this simplicity comes with trade-offs. You won’t find margin trading, futures, or advanced order books. This platform clearly isn’t built for speculative traders; it’s for people who want a functional wallet to move money quickly and cheaply.

Is Cryptomus Safe? Stress Testing Security Measures

One of the first things I checked in this Cryptomus Exchange Review was whether my funds were truly secure. I turned on 2FA and set up an anti-phishing code, then tried a few test withdrawals. Every time, the system asked for confirmation emails and 2FA codes before processing.

I deliberately mistyped withdrawal addresses to see if the platform flagged errors—it did. I also tested sending funds to multiple wallets to check consistency. The average processing time was under 3 minutes, even during a busy hour when BTC fees were spiking.

The one thing to keep in mind: Cryptomus hasn’t gone through massive stress events like FTX-style crashes. While it feels safe for daily transactions, I wouldn’t use it as a long-term storage option. Hardware wallets still win that game.

P2P Trading and Payments – Real-World Usability Test

I wanted to know if Cryptomus could replace PayPal for freelancing work, so I tested both sides of a transaction. First, I bought USDT on the P2P marketplace. The seller responded instantly, and the escrow held funds securely until we both clicked “Confirm.” This felt smoother than many Telegram-based P2P deals where trust is a guessing game.

Then, I tried invoicing a client. The platform generated a clean, professional payment page with a QR code and wallet address. My client—who had never used Cryptomus before—paid in under 10 minutes, and funds were available right away. No middleman delays, no frozen balances “for review,” which often happens with big-name processors.

This is where Cryptomus shines. It’s not trying to be a speculative trading hub. It’s a payment bridge for people who actually earn and spend in crypto.

Cryptomus Exchange Fees: A Clear Advantage

Credit From: cryptomus

Fees are where many platforms quietly cut into your earnings. In this Cryptomus Exchange Review, I was pleasantly surprised. P2P deals had zero maker fees on most listings. Swaps between BTC and USDT showed exact final amounts before confirmation—no hidden 0.5% deductions at the last step, which is common elsewhere.

When sending an invoice, I compared it directly to a PayPal USD transaction of the same value. Cryptomus saved me around 3% in processing costs, even after factoring in blockchain network fees. Over multiple transactions, those savings add up, especially for freelancers making small but frequent transfers.

Supported Coins and Networks: Practical but Limited

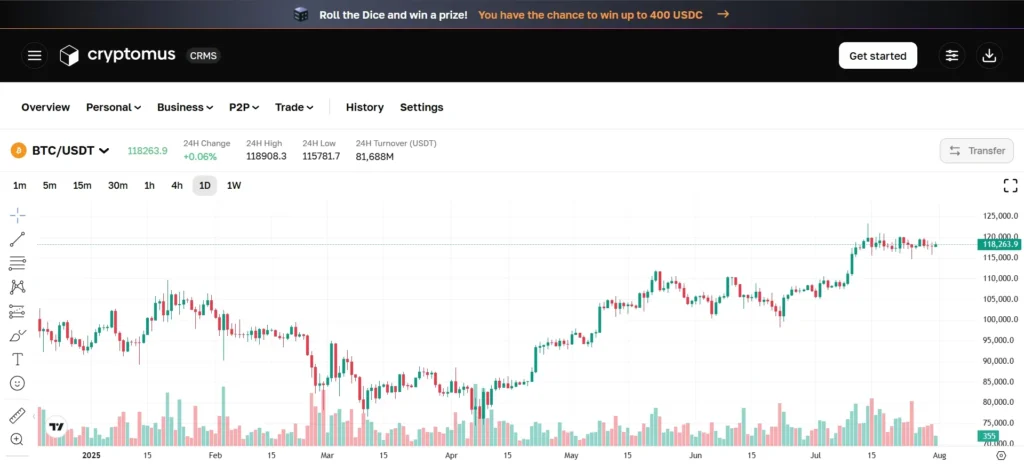

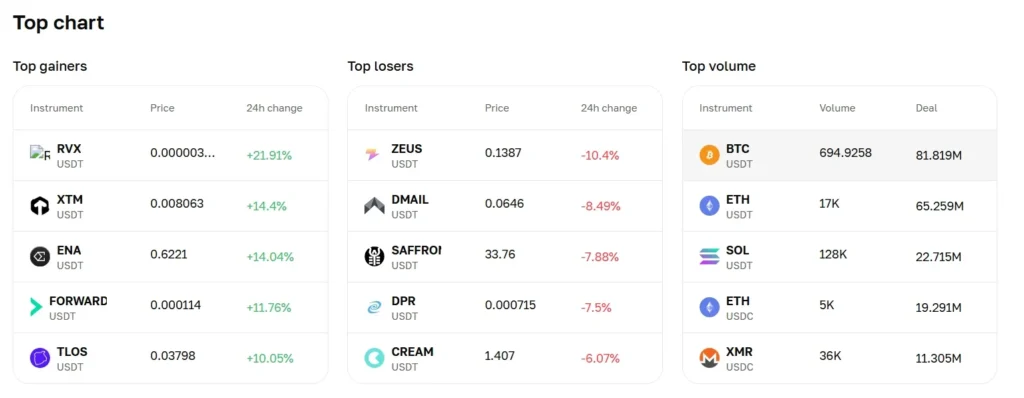

Cryptomus supports major assets like BTC, ETH, USDT, USDC, LTC, with several network choices (TRC20, ERC20, BEP20) to reduce transfer fees. During my test, I specifically chose TRC20 for USDT to avoid high gas fees, and it worked perfectly.

That said, if you’re looking to speculate on smaller tokens or DeFi projects, Cryptomus isn’t for you. There’s no trading pair beyond major stablecoins and blue-chip cryptos. This is a utility-first platform, not a playground for altcoin hunters.

Pros and Cons of Using Cryptomus Exchange in 2025

| Pros | Cons |

|---|---|

| Fast account creation and easy setup for beginners | No advanced trading features like margin or futures |

| Low, transparent fees for P2P and invoices | Limited selection of cryptocurrencies |

| Reliable withdrawals with no unexplained delays | Not designed for long-term storage of large funds |

| Merchant tools make it ideal for freelancers | No fiat bank on-ramps yet |

Final Verdict – Who Should Use Cryptomus?

After this hands-on Cryptomus Exchange Review, I can say it’s a niche platform done right. If you’re a freelancer, small business, or someone tired of waiting days for traditional payment processors to release your money, Cryptomus is a strong choice in 2025.

It’s not for traders seeking a full-featured exchange or investors wanting cold storage, but it nails its primary purpose: fast, low-cost, trustworthy crypto payments. If your daily life involves sending or receiving crypto, Cryptomus feels like the bridge between clients and your wallet that you didn’t know you needed.